Your cart is currently empty!

By Jack J. Phillips and Patti P. Phillips

This article was originally published in the April 2020 issue of Strategic HR Review.

The Situation

Leaders in industrial nations agree that to continue strong economic growth it is vital to support people to live healthier lives and stay in the workforce for longer. By doing so we can not only improve well-being and enable people to remain active an economically productive, but can also reduce dependency, bringing down the burdens on health, pensions, and social systems.1

From an organization’s perspective, the notion of extended retirement has its positives and negatives. In the negative category, older employees sometimes have much higher salaries, and this sometimes places a burden on compensation expenses. Then there are rules, regulations, practices, and stigmas that prohibit extending the retirement age, particularly in governments, large organizations, and unionized firms. Additionally, there may be others in the organization who wish the older employees would retire. Gen Xers and the Millennials want those jobs to open up creating more opportunities for promotions.

On the positive side, extending retirement means you keep the expertise you need, and knowledge is retained in the organization. This gives more time to ensure this knowledge is shared and acquired by others. Because of the tight labor markets, it may be difficult to obtain replacements for this level of talent, so extending retirement could help relieve the current talent shortage.

Our labor forces fuel economic growth—their size and participation rates, as well as their productivity. We are now experiencing a slowing down in the rate of economic growth after 11 years of strong growth. Unemployment is at a historical low point, fueling wage growth. It is against this backdrop that we examine the imperative for fueling growth through the better utilization of an aging and experienced workforce. To date, this rapidly growing segment of our population is not always addressed in inclusion and diversity plans and has often been overlooked as a source of competitive advantage, rather seen as a cost and a burden. It is time for a change.2

What’s the best way to solve this puzzle? Many organizations are creating proactive programs and policies to make this attractive to all parties. These organizations often let employees extend retirement by placing them in different roles that usually involve different pay structures. This article explores several ways to tackle this issue with a discipline to show a win-win for all parties.

The Problem with Early Retirement

The trend is now to delay retirement, and most of this has been initiated and driven by employees who are not ready for retirement for a variety of reasons. Employers have done very little to try to push this issue of delaying the retirement of their employees, although much evidence points toward the delay as perhaps the proper action to take. Here are some reasons why early retirement is not working:

I Love What I’m Doing

Let’s face it. Some people are excited about their work. They enjoy the challenges and successes that they are able to achieve. For years, employers have been measuring and improving job satisfaction, job enrichment, and employee engagement. When employees are fully engaged, they feel more ownership in the business, more connected to the organization, more responsible for their work, accountable for their goals, and are productive members of a team. When this happens, they enjoy their work, are fully engaged, and want to stay.

I Can’t Afford to Retire

According to The World Bank, the average life expectancy at birth has risen quickly over the last 50 years, from 56 in 1956 to 72 in 2016.3 Although reaching the age of 100 is still uncommon, roughly half of those born today in the developed world are expected to live past 100. These extended life expectancies have caused a short-fall in being financially prepared to live that long. The amounts saved for retirement will fall short of the money needed to get reach these ages.

Government retirement replaces only about 40 percent of a typical paycheck. Employer pensions are much less common today than in the past, and relatively few people have saved enough to guarantee a financially secure old age.4 Workers who extend their careers can save part of their additional earnings for retirement, and they can accumulate more government retirement credits. What’s more, retirement savings don’t have to last as long when workers delay retirement.

If I retire, I will die

William Shatner, Captain Kirk from the Star Trek series, is currently at 89 and makes an important point. He doesn’t have time to retire. He says, “I cannot die because tomorrow I’m fully booked.” Shatner is always booked, and he emphasizes a good point that if we are busy, we seem to live much longer. There is much data to support this.

Consider a 2018 study by Maria Fitzpatrick at Cornell University and Timothy Moore at the University of Melbourne, which used administrative data covering the entire U.S. adult population to examine how mortality rates change at age 62 when people can first begin collecting Social Security retirement benefits. They found that men are 2 percent more likely to die in the month they turn 62 than in the previous month.

Alice Zulkarnain and Matthew Rutledge at the Center for Retirement Research at Boston College concluded that delaying retirement reduced the five-year mortality risk for men in their early 60s by 32 percent. The result: Many of these studies clearly show that health problems intensify after workers qualify for retirement benefits and abate after policies encouraging work are introduced.

I Might Lose My Social Network

Another risk for retirees is that leaving the workforce can cause them to be socially isolated. Most employees interact with their colleagues, essentially providing camaraderie and building social support. Although it may appear that retirement would provide an opportunity to increase social ties, research has shown that during retirement, social networks become smaller and social isolation tends to dominate. This reduces life satisfaction and can impair physical and mental health.

The Case for Delaying Retirement

Obviously, the problems associated with early retirement can be addressed if delayed retirement options are available, organized, and promoted by employers. There are important benefits associated with providing delayed retirement options to employees.

Experience is Maintained

There is no doubt that boomers bring knowledge and experience to the workplace and many organizations need these skillsets in many ways. Organizations risk the loss of critical institutional knowledge that cannot be easily replaced when those in the experienced workforce leave. From remembering how the initial products work and can be repaired to clearly understanding the relationships with key customers who have been with the organization for a long time, there are many reasons why this experience is needed and needs to be shared and retained in different ways.

Talent Shortage

Almost every organization today is facing a serious talent shortage, not finding the employees with the experiences they need. Organizations are pushing the older, more experienced employees toward early retirement options while desperately needing new, experienced employees. Older employees can keep an organization from having this shortage, or at least, can minimize the effects of the shortage.

Use in Different Roles

Sometimes it is helpful to use the knowledge and skills of seasoned, older employees to tackle important issues in the organization, using that capability and know-how in different ways so that their experience can be harnessed.

To Reduce Costs

If done properly, delaying retirement can actually reduce costs in two specific ways. First, there is a strong likelihood that the retirement expense can be reduced. Many companies are faced with a heavy debt load because of their liabilities with pensions. They have many people on retirement and the liability to fulfill those obligations is creating a huge financial burden on the organization. Often this to the point where most employers have abandoned that traditionally defined benefit plan and switched to defined contribution plans. Still, these costs are heavy. By delaying the actual retirement date, there is a monetary savings in most plans because there is a delayed period of time when the actual retirement benefit is being paid. The organization can ultimately save money with the retirement savings.

Second, if the organization is smart with solutions to use delayed retirement, costs can be reduced by retaining these individuals in roles that are necessary and are adding value. In essence, the delayed retirement solutions should have a benefit-cost analysis around them. So that their costs to the organization are less than the actual monetary savings that they are generating.

The Approach: Many Options are Available

The approach suggested in this article is to take a fresh look at delayed retirement as an option under certain fundamental principles. No two organizations are alike, and so there is no solution that works best for all. It depends on the situation.

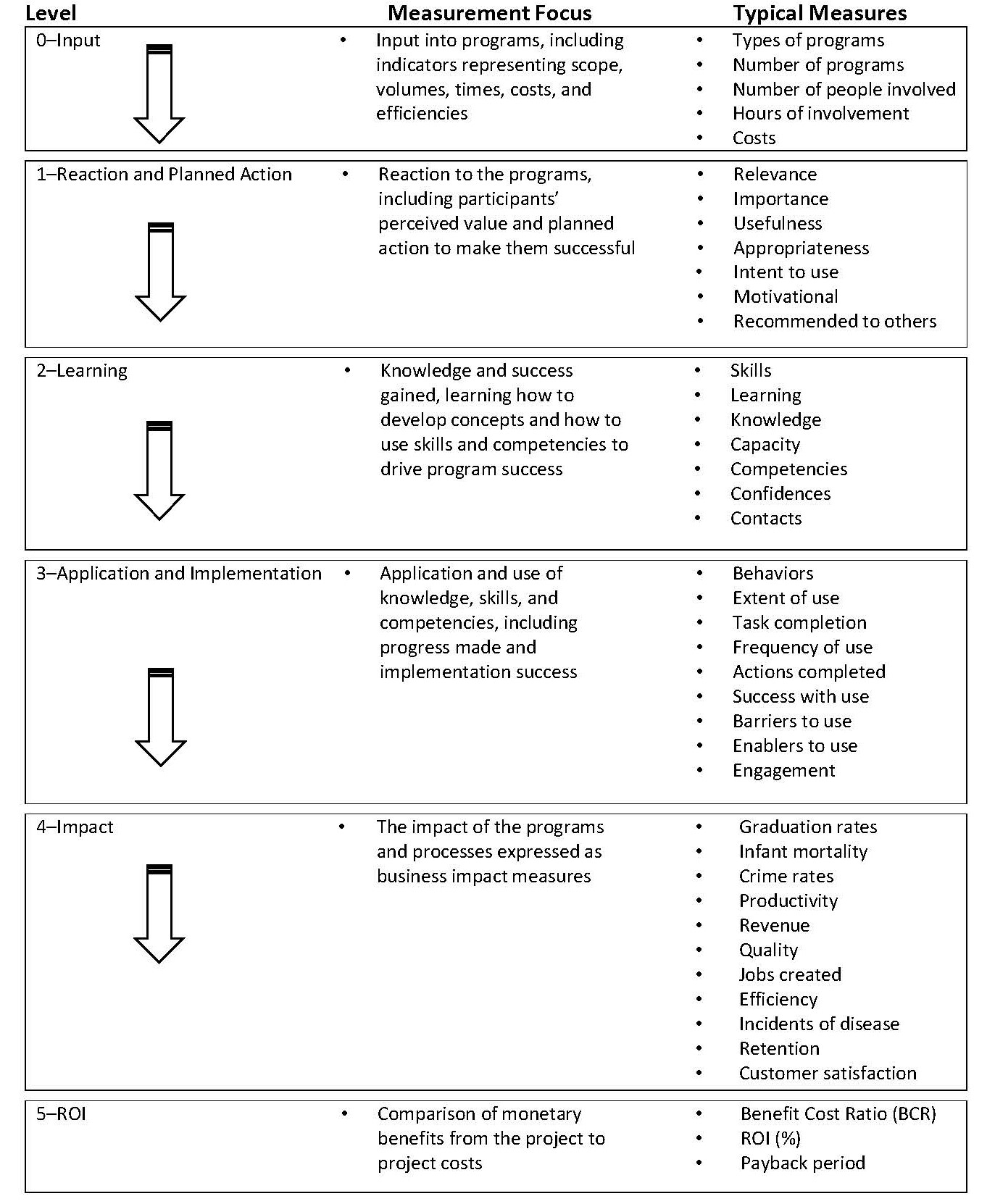

It is important that the solution drives business value and, ideally, even a positive ROI. Figure 1 shows a list of data sets that form a chain of value as particular programs move from Level 0, which is the Input into the process to the financial ROI.

Figure 1. Six Categories of Data

Here is a full range of possibilities to creatively address delayed retirement solutions. All these are implemented with the objective of providing an opportunity for a person to postpone retirement, provide income to continue to their savings for retirement, and make room for others in the organization.

Reducing Workload until Full Retirement

This option lets an employee phase-out of the work and reduce income over a period of time. This could be a reduction in work hours or even fewer days per week at work. It could be a reduction in workload or assignments as well. Instead of an abrupt retirement date that would be normally pursued, this allows a phased approach that enables the transition to retirement and provides a revenue stream to continue for some significant period of time. For example, a school system allowed the tenured teachers who were eligible for retirement to continue to teach with a reduced schedule.

Teaching Others in a Formal Setting

With this solution, experienced employees have an opportunity to rotate into the learning and development team to teach specific courses of their specialty. The experienced employees could bring a wealth of insight into these programs. For example, in an electric utility, senior engineers nearing retirement were given an opportunity to move into Learning and Development to teach courses for new employees. This brought a much-needed experience base to teaching the newer employees.

Coaching

Seasoned employees can make excellent coaches. In one biotech company, the senior (nearing retirement) group of executives were prepared for coaching assignments and coached the other employees to help make them more successful in their work.

Mentoring

Instead of coaching, some employees can serve as mentors, giving advice to new employees to help them navigate the process, the work, the environment, relationships, and careers. Mentors can make a difference in keeping a new employee and improving their performance in productivity, timeliness, and quality. For example, an electric power company in Western Canada uses seasoned employees as mentors to the newer groups throughout the system to make sure that they are successful and remain with the organization.

Onboarding Assignments

Most onboarding processes cover information about the history of the organization and how certain processes and procedures were evolved through the current state. This creates an excellent opportunity for the most seasoned employees to be involved in these onboarding assignments. For example, in Microsoft, Bill Gates, CEO, took on the challenge to participate in the onboarding processes of new employees. He thought it was so important to get people started in the right direction, that he wanted to be directly involved. This reduced the likelihood of the employee leaving early in the employment cycle and also increased the productivity and quality of their work.

Recruiting

When appropriate, seasoned employees can make excellent recruiters. For example, in one CPA firm, the employees nearing retirement were involved in recruiting trips to universities to help explain the organization, what it does, and the mission, vision, and values from the perspective of a person who has lived it.

Alumni Groups

Some companies pride themselves on maintaining a connection with those who leave the firm. They essentially form an alumni group, and the company attempts to keep in touch and even organizes activities so that there is a connection back to the firm. In one large consulting firm, an impressive alumni group was created, and this providse a huge payoff for the organization in attracting new people.

System Implementation

A large-scale system needs much expertise in the organization to ease the implementation. This will ensure that it will be properly integrated and major issues are addressed, particularly those things that can go astray and cause problems. For example, in one NGO that makes loans to developing countries, a new system was implemented and used to collect, capture, and track data on the economic outlook of various countries. This is an important process for this NGO, and it was important for this system to be implemented properly so that it is a value-added process, delivering more value than it costs. Senior leaders nearing retirement were placed on the system implementation team to make sure that it was successful from every aspect.

Knowledge Transfer

Similar to knowledge transfer is important. As knowledge in the organization is transferred to others and in particular the newer employees, through a variety of different activities, it ensures that the proper knowledge is shared and understood by those who need it in the future. For example, Sandia National Laboratories has been concerned about their knowledge transfer as so many of their employees are nearing retirement age. These senior leaders served as mentors for a knowledge transfer program and were placed in positions so they could ensure that the knowledge is transferred to the appropriate groups and individuals throughout the system. This has not only helped in terms of ensuring that they have the capability in the future but to make sure that their processes are efficient and effective now.5

Special Assignments, Special Projects, and Task Forces,

It is helpful to put senior leaders into special assignments, special projects, and roles in task forces as they use their knowledge to help a group who actually needs this expertise or capability. For example, a major pipe manufacturer had implemented several special assignment options. In one of those, for example, employees near retirement, experts in manufacturing and production, were assigned to the field sales team to help them understand information about a product and its manufacturing processes. This helped the field sales team address many questions and issues with the customers. In this same organization, the senior employees with extensive customer service were also assigned to the product design team. This helps bring the customer perspective to the product design process, ensuring that products are designed from every angle with the customer in mind.

Problem Solving Team

Sometimes there is a persistent problem nagging the organization that needs to be solved, and much expertise is needed to address this problem. Here, the most senior people nearing retirement age make ideal candidates to tackle these types of problems. For example, one automobile company tackled the problem of having too many product recalls, which were destroying the company in terms of its image and reputation as well as the operating costs. This problem-solving team had many near-retirement people involved so that their expertise in their specialty areas could help make the effort to reduce this important metric a success.

Documentation

Sometimes an organization needs to document what knowledge they have in a format that can be easily accessed and used by others. In one large engineering and construction company, what they had learned from their various projects was detailed in a book of knowledge. This became a useful, indispensable guide for new engineers, design teams, and construction supervisors. This process was built by individuals who were nearing retirement age on a special assignment.

Advantages of This Approach

These new approaches to delayed retirement have several advantages when you consider the scope and variety of solutions.

In Almost Every One of These Examples:

- The organizations made room for other employees to be promoted or assigned to the job, freeing up jobs for Gen-Xers and Millennials to advance upward in the organization.

- The organizations retained, documented, or made available the experience of the seasoned employees destined for retirement.

- The senior employees nearing retirement improved the performance of others by using their experience, knowledge, and capability. This made for a much better workforce and one that becomes more appreciative of the senior team as they head toward retirement.

- Potential retirees were provided more time to prepare financially for retirement.

- The brand of the organization was enhanced.

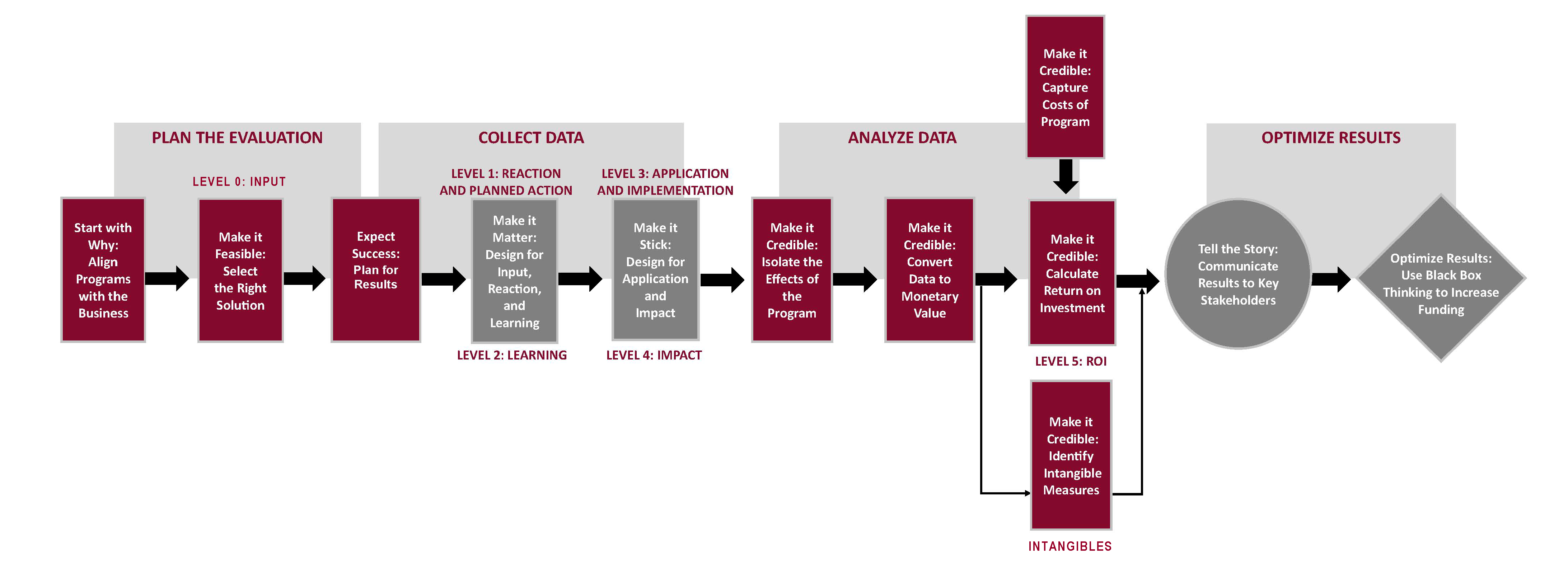

The success of the program was measured all the way through to the impact and, in some cases, the financial ROI. This clearly showed that they are good investments to undertake, and they deliver more value than they cost. The programs were evaluated using a process called the ROI Methodology, as displayed in Figure 2. The methodology process follows 12 steps and can be implemented to evaluate the success of any of these types of programs, projects or solutions.

Figure 2. The ROI Methodology

Final Thoughts: The Challenge

The challenges facing organizations are significant. Demographic and economic trends are placing tremendous pressure on organizations to develop a robust strategy related to the experienced workforce. When an organization tackles these challenges with innovative approaches, it can make a tremendous contribution to the organization and to the individuals involved. This will ultimately better position the organization to navigate challenging times and accelerate growth.6

References

- Milligan, Pat, Rick Guzzo, Haig Nalbantain, Yvonne. Sonsino, and Patty Sung. “Next Stage: Are You Age-Ready? Mercer Research Report, 2019.

- Milligan, Pat, Rick Guzzo, Haig Nalbantain, Yvonne. Sonsino, and Patty Sung. “Next Stage: Are You Age-Ready? Mercer Research Report, 2019.

- The World Bank, “Life Expectancy at Birth, Total (Years),” available at https://data.worldbank.org/indicator/SP.DYN.LE00.IN.

- Johnson, Richard W. “The Case Against Early Retirement.” The Wall Street Journal, April 22, 2019.

- Fromm-Lewis, Michelle. “Using Mentoring to Enhance Technical Knowledge Transfer,” in Creating Mentoring and Coaching Programs (In Action Case Study Series), edited by Jack J. Phillips and Linda Stromei. Alexandria, VA: ASTD Press, 2006.

- Milligan, Pat, Rick Guzzo, Haig Nalbantain, Yvonne. Sonsino, and Patty Sung. “Next Stage: Are You Age-Ready?” Mercer Research Report, 2019.